III. Termination of Management Company

In late 2018, several residents strongly in favor of self-management, including SHOAR’s founder, ran a vigorous campaign and were voted onto the board, forming a majority. The remaining minority resigned, resulting in a board completely committed to getting rid of the management company. The previous board had recently signed a new contract with the company, which if broken had a substantial cancellation fee, unless the company was terminated for valid cause. The new board was confident that they indeed had more than ample cause for termination. SHOAR’s founder dove into the task of finding and documenting this.

The management company took weeks to provide the new board access to their own website, which caused a delay, as much of the evidence to support termination was on the site. However, ultimately a thoroughly researched document was produced, which contained very specific, provable examples of where the management company had failed. At the same time, the board was working on other things necessary to complete the move to self-management.

On January 28, 2019 the termination letter was sent to the management company via USPS Certified Mail. They were not happy, but also did not refute any of the evidence cited, and stated that they were not contesting the termination. They began termination procedures right away, which are a series of duties, spelled out in the contract, that are executed according to a set timetable. In summary, they turn over all access to the HOA’s money, domain name, all records, and cease all activity with the HOA in 30 days, which would end on February 28, 2019.

The following is an excerpt from one of the detailed updates made by the board to the subdivision throughout the termination process:

After February 28, the management company will be a thing of the past, and this board wants to leave them behind as a painful and expensive memory, and mistake, and speak of them no more. They cost us an enormous amount of money, and in our opinion, provided in return appallingly poor service, fraught with grave errors. As bad as our opinion was, after downloading the documents from their website and going through just some of them, we saw that the reality was worse.

We wanted to present here a few of the most shocking things we found, just to alleviate any doubts or fears some may have about this long overdue termination.

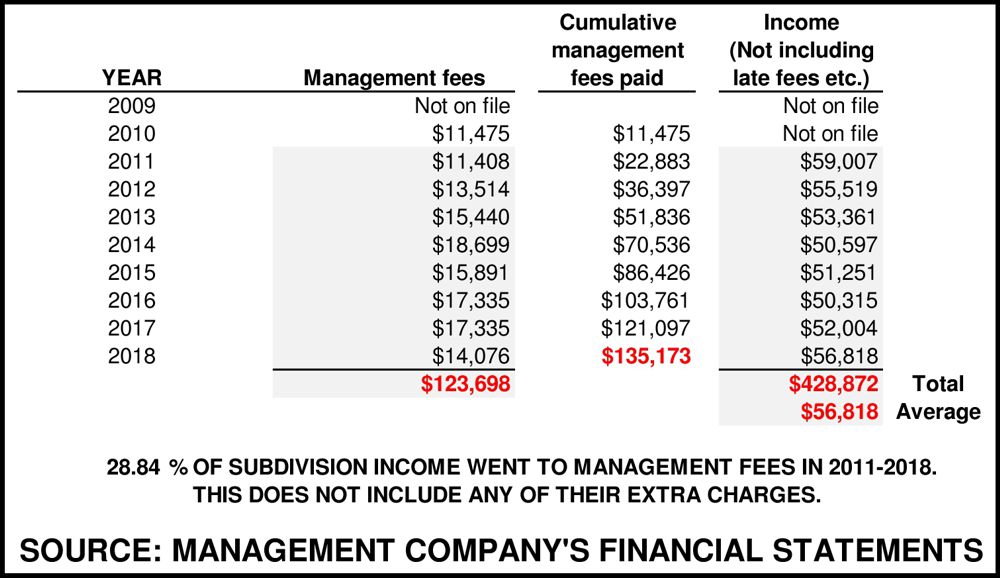

All of the figures provided were taken directly from the financial statements provided by the management company on their website.

First of all, the management company was hired sometime in 2008. They did not provide any financials for that year, or for 2009. In 2010 they provided expenses but not our income. We have income statements for the years 2011 through 2018, and balance sheets for some of those years. However, the balance sheets have a serious flaw which will be discussed below.

The following chart shows the income and expense figures for these years. From 2010 through 2018 we paid the management company $135,173 in fees alone. Keep in mind that they charged extra for every little thing they did – every letter, every extra service, no matter how small. Such extra charges are not included in the figure shown here, nor are the fees from 2008-2009. So, the total we have paid to them since the beginning is far higher than $135,173.

If you compare the fees to income in those years where income was provided (gray shading) you see that 28.84% of our entire budget was spent just on the management company’s fees alone. Add to that the extra charges, and that percentage is significantly higher. (It is too tedious to accurately calculate the extra charges because they are broken up among many different categories, but they are significant.) As you can see, our expenditures to the management company were enormous.

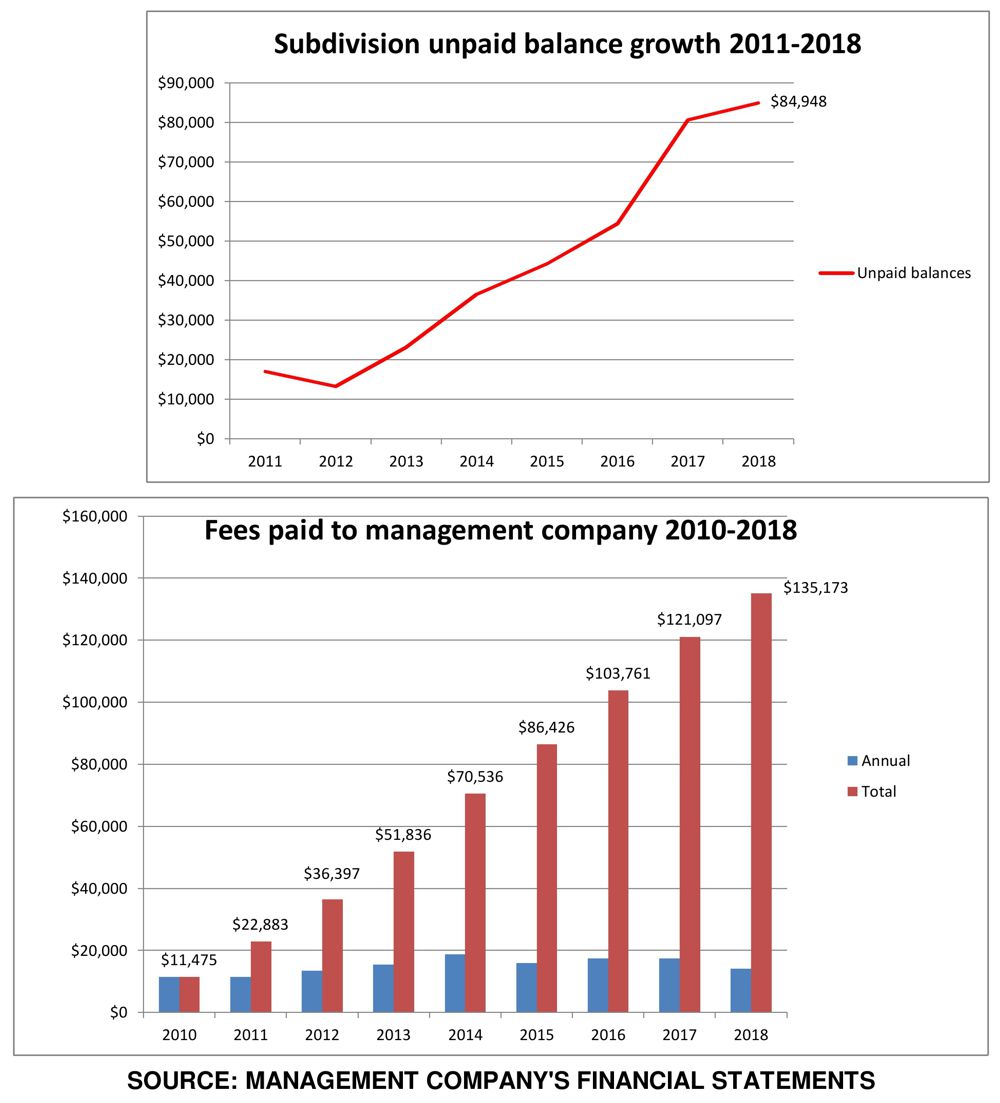

We also looked at the amount spent on the management company compared to uncollected dues and other balances owed to the HOA. Our former management company and all management companies claim that hiring them will improve collections and cash flow. However, the table below shows in devastating detail that the exact opposite occurred.

The management company provided no records of bad debts (accounts receivable) for 2008-2010. In 2011, our accounts receivable balance was $17,054. Over the next 8 years, at the same time we were paying the management company $135,173 in fees, our accounts receivable increased to a whopping $84,948. This is almost a fivefold increase!

Earlier we mentioned a serious flaw in the financial statements provided to us by the management company. That flaw involved the accounts receivable (unpaid balance) shown in the chart above. Although the aging reports provided to the boards showed these balances, the balance sheets (which residents can access) stated that accounts receivable is only $500.00 (five hundred dollars). Every single balance sheet, from now back to the oldest we can find, shows this amount. So, while the true unpaid balances were as much as $84,948 the financial statements still reported it as being $500.00. We had a CPA look this over for us (at no charge) and their reaction was that if they were to present these figures in this manner, they would lose their license. As we asserted in our termination letter, we feel that the financial statements provided by the management company are and have long been a gross misrepresentation of the true state of our finances.

[Note: It was later determined that the management company was generating financial statements for the residents using the cash method of accounting, resulting in the accounts receivable balance never changing from $500.00. These statements were all that residents could see, while at the same time the true accounts receivable, which were not visible to them, skyrocketed to almost $85,000.00!]

We downloaded each and every document contained on the management company websites. Among them was all invoice and payment data which they still have. This goes back approximately 6 years, to early 2013. Nothing earlier than that exists. We started browsing through the data, and immediately noticed a few disturbing things:

- We saw that the out of state account in which the management company held the majority of our money only paid 0.05% (ZERO POINT ZERO FIVE PERCENT) interest! In all of 2018 we earned just $28.76 of interest on a balance averaging around $50,000! The local banks who want our business are paying about 1.98%, so on that same balance we will earn approximately $1,000 of extra income per year. We are shocked that the management company put our money in an account with essentially ZERO interest, costing us thousands of dollars in lost income over the years.

- The vast majority (about 2/3) of our utility bills (electricity and water) were consistently paid late. Each of our 3 entrances has a water and electrical meter, making 6 bills total. Every month, on average 4 of those were paid late. The late charge was sometimes over $10.00. However, let’s use $1.00 to be super conservative. That amounts to $4.00 per month in late charges, times 12 months, times 10 years of the management company, equals $480.00 thrown away because the management company did not pay them on time, wasting OUR money! Again, the true total is a lot higher than $480.00, because many of the late charges were much more than $1.00.

- We noticed that there was a very large invoice in our Accounts Payable file, which was just entered. We recognized the vendor and the amount. Apparently the company who submitted a bid for the landscaping at the entrances sent a copy of the estimate to the management company. It was clearly marked ESTIMATE, but they entered it as an invoice to be paid! We were utterly dumbfounded.

These are just a very few of the multitude of inexcusable errors and what we consider gross negligence on the part of the management company. There are many more. We wanted to present you with these examples so you, our residents, can get some idea of how our money has been wasted on unacceptable service for the last decade. While we cannot get it back, we can learn from this mistake, and never make it again.